cryptocurrency tax calculator australia

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. Assessable income is calculated by.

Crypto Tax In Australia The Definitive 2021 2022 Guide

BearTax - Calculate File Crypto Taxes in Minutes.

. Yes you can CryptoTaxCalculatorAustralia is designed to generate easy tax reports. June 27 2022. However its best to speak to a tax accountant who specialises in cryptocurrency for further advice.

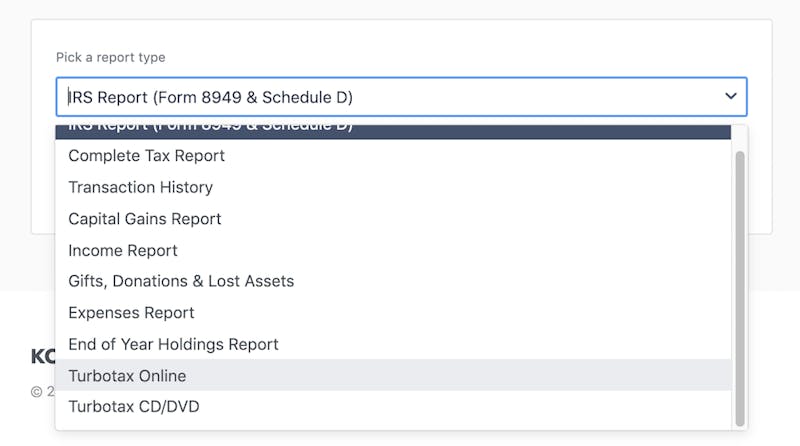

Dont have an account. You simply import all your transaction history and export your report. CoinSpot Crypto Tax Guide.

It provides users with an extremely user-friendly app which can be connected to all of their exchange platform accounts to seamlessly pull all the necessary transaction history data needed to get an accurate overview of the users tax slots. Rated 46 with 700 Reviews. Over 600 Integrations incl.

As an investor you can use either FIFO HIFO or LIFO to calculate capital gains as long as you can individually identify your cryptocurrency assets. Tailored as per the ATO guidelines the algorithm provides an accurate report of your crypto gainslosses for a financial year. Hold for more than 12 months.

Quick simple and reliable. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Crypto Trader Tax is one of the most popular cryptocurrency tax calculator platforms on the web.

ATO How to minimize cryptocurrency taxes. Calculate Your Crypto DeFi and NFT Taxes in Minutes. Crypto cost basis method Australia.

This means you can get your tax details up to date yourself allowing you to save significant time and reduce the bill charged by your accountant or tax agent. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on the ATO website and does not. Crypto Tax Calculator Australia prides itself on making it simple and easy for you the customer to use our top of the range service and application when it.

Assessable Income Income Capital Gains Deductions. CryptoTaxCalculator has partnered with leading Australian cryptocurrency exchange CoinSpot offering seamless integration between the two products. Get Started For Free.

Save 70 on accounting fees by providing them auto-generated document. Bitcoin tax calculator australia. Australias first crypto accounting and tax tool which has been vetted by a Chartered Accountant.

Total income tax will be AU5092AU8125 AU13217. Cryptocurrency tax rate. Australias Leading Crypto Tax Tool.

While it may seem a little bit expensive at first it will at some point spend for itself. Compliant with Australian tax rules. As a trader the ATO requires you to use FIFO when calculating your crypto Income Tax.

5 tax on income from AU45001 to AU70000 which equals to AU8125 in this case. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

So your total tax liability for the year will be AU13217AU1400 AU14617. Swyftxs cryptocurrency tax calculator Australia gives you an estimate of what tax youll pay on profit made from a crypto sale. Bitcoin tax calculator australia.

Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800. Being one of the earliest fully featured trading platforms that facilitate crypto to crypto transactions it exciting for us to offer complete support for CoinSpot users. If youre classed as a cryptocurrency investor youll be taxed on any capital gains resulting from your crypto transactions.

If you are a cryptocurrency investor your tax rate will be determined by your overall assessable income based on Australias sliding scale of individual tax rates. The initial attribute to consider when choosing a crypto tax software is its cost. The most effective programs will permit you to import as well as export purchases and produce tax obligation records automatically.

Further 2 Medicare levy tax on income of AU70000 comes to AU1400. How is crypto tax calculated in Australia.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Adaugă Pin Pe Idea Inspiration

How To Calculate Crypto Taxes Koinly

Easy Guide To Crypto Taxes For 2022 Gordon Law Group

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Convert Bitcoin To Aud Cashout Bitcoins To Australian Dollars Buy Cryptocurrency How To Become Rich Bitcoin

Crypto Tax In Australia The Definitive 2021 2022 Guide

Crypto Tax In Australia The Definitive 2021 2022 Guide

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

Pin On Blockblog Fr Le Meilleur De L Actualite Bitcoin Blockchain Crypto Francophone International

Koinly Crypto Tax Calculator For Australia Nz

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

Daily Asia London Sessions Watchlist Aud Jpy Bank Of Japan Australia House Bank Of England