capital gains tax budget news

1 lakh per annum. There are two main categories for capital gains.

With The 2nd Year Of A Projected Budget Surplus Should California Consider Cutting Taxes The San Diego Union Tribune

If sold within 2 years its SHORT Term Capital gains or loss.

. Moreover tax at 10 will be levied. Capital Gains Tax was introduced on 1 October 2001. Additional Information Governor proposes 9 capital gains income tax.

The base cost is the purchase price plus. Since the 2013 budget interest can no longer be claimed as a capital gain. As a follow-up to this weeks 2022 Federal Budget the Government has today announced the application of a capital gains tax on.

Coming in at a total of 4968 billion the Senates budget plan tops Gov. It is not just opponents of a capital gains tax who call it an income tax. If the property is sold after 2 years changed in Budget 2017 and applicable from April 1 2017 of purchase the corresponding gains or losses is called LONG Term Capital Gains or Loss.

As per Budget 2018 long term capital gains on the sale of equity shares units of equity oriented fund realised after 31st March 2018 will remain exempt up to Rs. Capital gains tax is a tax you pay to the government when you make a profit by selling your investment property or something else of value for more than you originally paid for it. It forms part of normal income tax and is based on the sliding tax tables for individuals.

Their combined income places them in the 20 tax bracket. And for SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. This means long-term capital gains in the United States can face up to a top marginal rate of 371 percent.

In 2021 for singlemarried filers the capital gains tax rates have been set at. In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains. As a married couple filing jointly they were able to exclude 500000 of the capital gains leaving 200000 subject to capital gains tax.

As commissioner of the state Department of Revenue in 2016 current Baker administration budget chief Michael Heffernan determined that 100 percent of the 37 million capital gain earned when VAS. DOF-DBM-DILG Joint Circular No. It comes about most often for taxpayers when their home or investment property is sold for a profit gain ie.

Lets use the example above where someone has 40000 in all say long-term capital gains in Q1 2021 and the federal tax due is exactly 6000 ie. The proceedsselling price is more than the base cost. Local Budget Memorandum No.

A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory asset. Short-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains. If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income.

If you have more than 3000 in excess capital losses the amount over 3000 can be carried forward to future years to offset capital gains or income in those years. For example if you spent 310000 on buying a house years ago and sold it for 500000 today then your capital gains would be 190000 and youd have to. Here are the details of the new Capital Gains tax rule applicable on all long-term gains from February 1st 2018.

Long Term capital gains from property is taxed at flat rate of 20 after. It is time to stop pretending whether a capital gains tax is an excise tax or income tax is an actual tax debate. Provided That the historical.

0 15 and 20. PEZA pushes review of investment laws - Philippine Star. What is a CGT event.

If you happen to have a billion dollar exit on your reinvested capital gains that can be tax free but youre still paying tax on the original gain. CGT event is the date you sell or dispose of an asset. However if the asset is owned by a company the company is not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains.

Every tax authority in the country calls a capital gains tax an income tax. Charlie Bakers January proposal by over 1 billion and last years spending by. Short-term capital gains are taxed at your ordinary income tax rate.

The 1990 and 1993 budget acts increased ordinary tax rates but re-established a lower rate of 28 for long-term gains though effective tax rates sometimes exceeded 28 because of. The most common capital gain are realized from the sale of stocks bonds precious metals real estate and property. Capital Gains Tax.

At the state level income taxes on capital gains vary from 0 percent to 133 percent. You still owe capital gains on the original proceeds deferred a few years and with a possible 10-15 basis step up. What is Capital Gains Tax.

Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total. The formula is the same for capital losses and these. Long-term capital gains are taxed at only three rates.

This isnt zero capital gains tax. Id like to clarify an important detail about the exact amount to pay for Quarterly Estimated Tax Payments for Capital Gains. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

0 Percent 0-40400 Single0-80800 Married 15 Percent 40401-445850 Single80801-501600 Married. Any profit or gain that arises from the sale of a capital asset is a capital gain. Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

Short Term Vs Long Term Capital Gains. 50000 - 20000 30000 long-term capital gains. 18 calendar months from the date of sale or disposition shall be exempt from the capital gains tax imposed under this Subsection.

A major reform has been done in respect to Capital Gains tax on shares in the recent Union Budget 2020-21. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

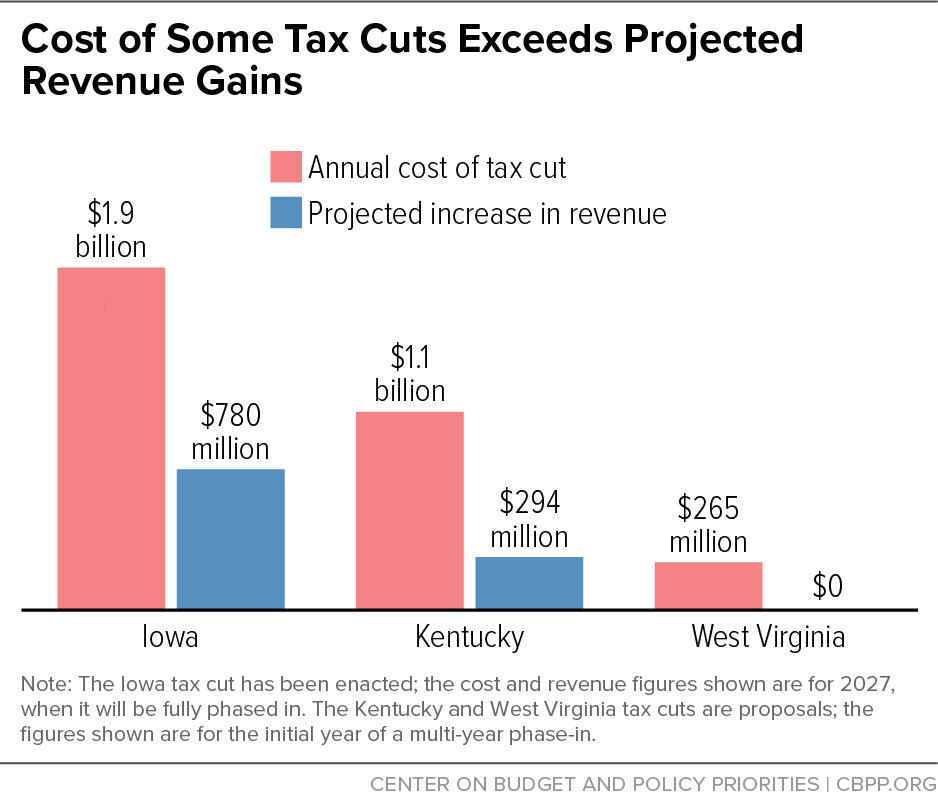

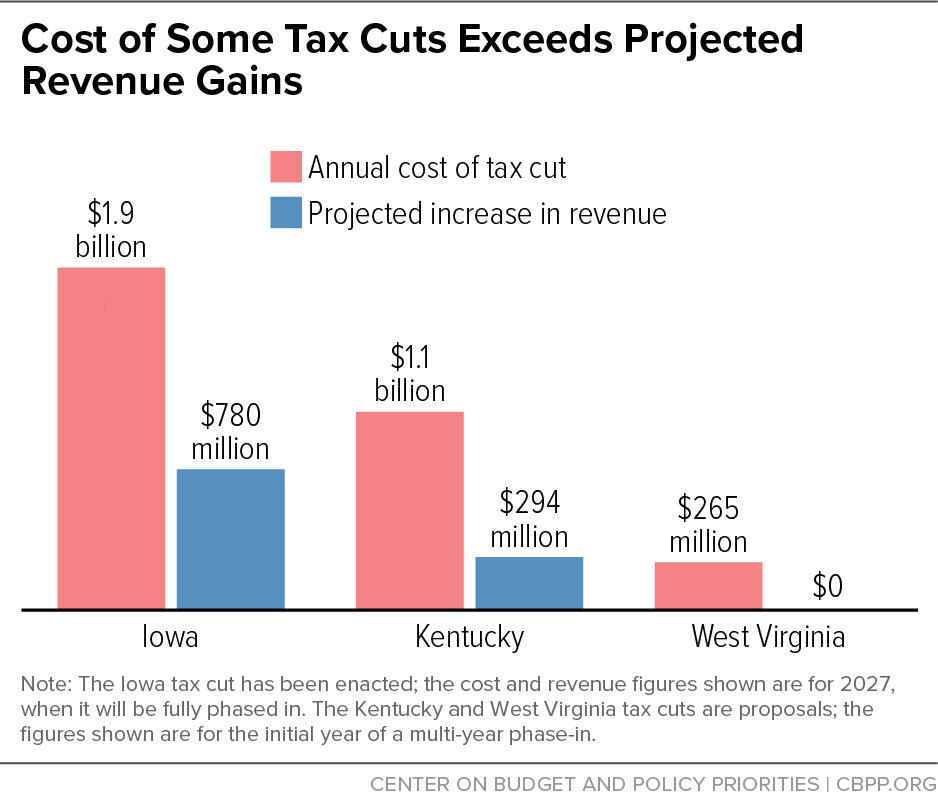

States With Temporary Budget Surpluses Should Invest In People Not Enact Permanent Tax Cuts Center On Budget And Policy Priorities

Income Tax Changes Announced In Budget 2022 Cryptocurrency Tax New Itr Rule Ltcg And More

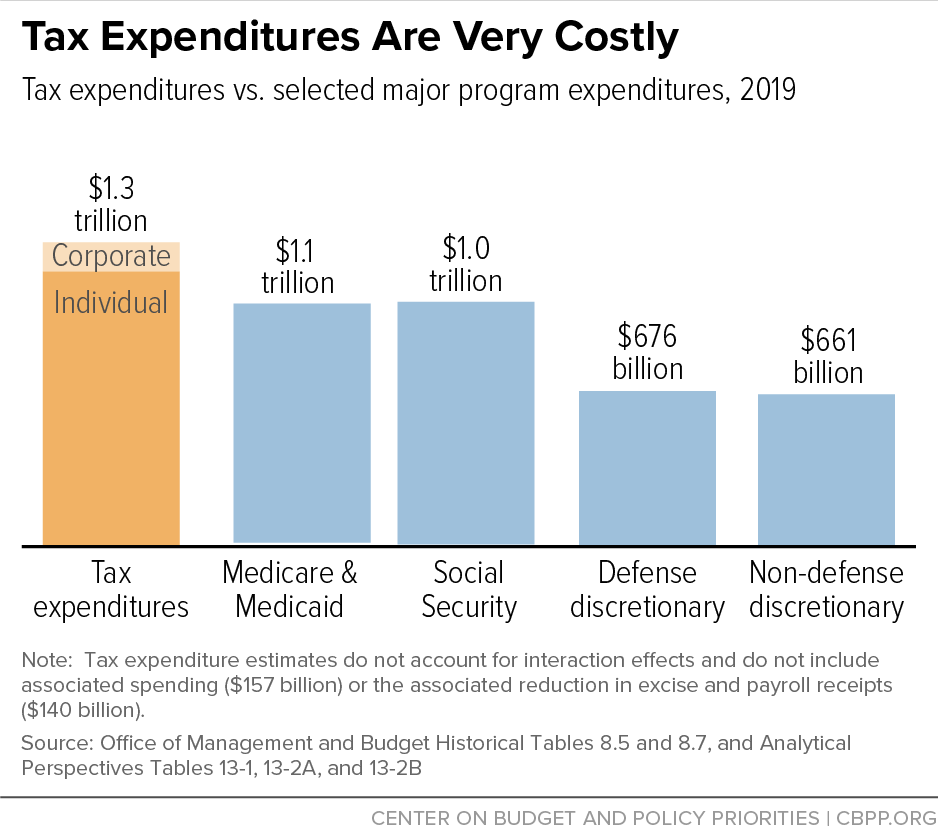

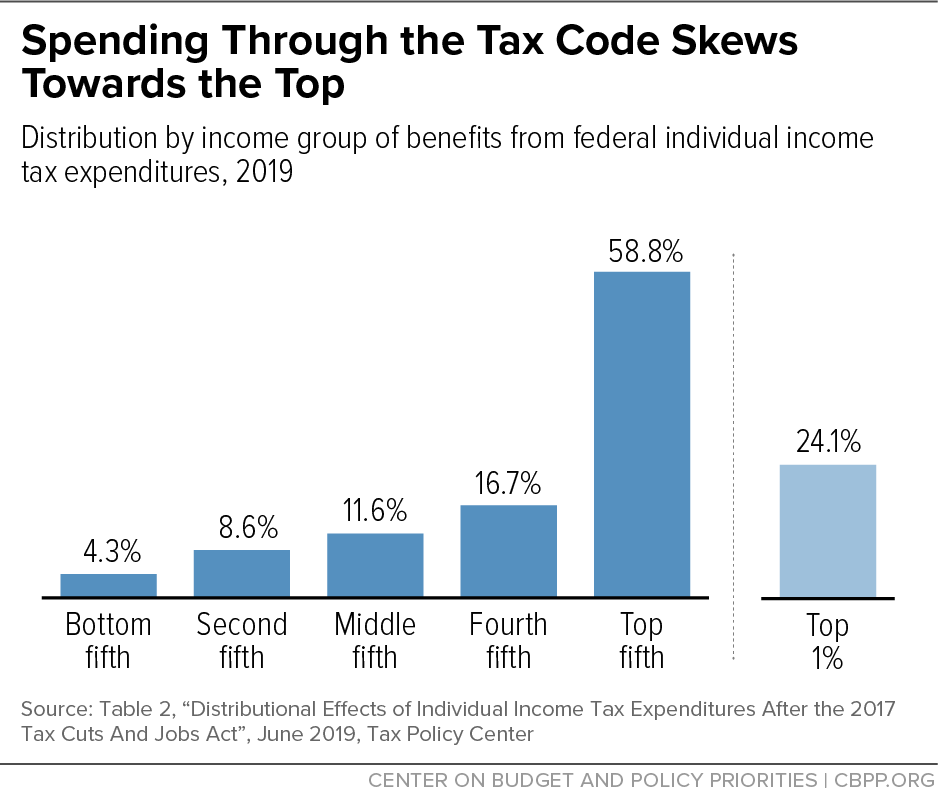

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Direct Tax Proposals In The Finance Bill 2021 Finance Tax Proposal

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

Biden Tax How Would Biden S Billionaire Minimum Income Tax Work Cbs News

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

Chart Book The Need To Rebuild The Depleted Irs Center On Budget And Policy Priorities

Biden S Better Plan To Tax The Rich Wsj

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

There S A Growing Interest In Wealth Taxes On The Super Rich

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Analysis Of President Biden S 2023 Budget Center On Budget And Policy Priorities

Game Spend The 2022 California Surplus Budget Calmatters

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World